How fintech can help fight global warming

Drastic efforts are needed to put a stop to global warming and all sections of the economy and society must be united behind these efforts. This includes the financial services sector which has the resources to ensure that sustainable investments and sustainable business models are prioritised.

Data-driven financing and business models for climate resilient infrastructure assets

Big data analytics has proven to be a powerful tool for creating innovative business models that have positively impacted operational efficiencies and capital expenditures. Pilot applications for monetizing different infrastructure assets, such as water, energy, mining and toll roads, have been successful because they lend themselves to new efficiencies and real-time valuation. The following case studies illustrate this.

Smart highways

Data on traffic patterns gathered by government agencies can also be sold to insurance companies. In the United States, experiments are underway to see how these insights could be used to price a fee structure for logistics companies based on how they reduce lifetime use or maintenance requirements on roads and bridges. Although the business and cash flows models are still under development and being tested, provisional public private partnership agreements are being negotiated between technology companies and state agencies.

Smart water plants

Cash-starved public water agencies are using digital solutions to improve operational efficiencies, reduce the risk of leakages, and to help them avoid major outages. These data solutions also include the conversion of capital expenditures to long term operational cash flows to pay for the delivery of water services. Municipalities are forming public private partnerships to develop long term solutions to this problem. The municipalities mandate contracts that include rights to the data collected from sensors, and in some cases stipulate on-premises solutions with high security measures.

New blockchain-based energy

Technology companies in the US, Belgium, Germany and the Netherlands are piloting blockchain applications to aggregate, distribute and manage decentralized energy supply and demand. This allows residential owners to buy and sell energy within an energy marketplace of consumers using so-called smart (automated) contracts. It also helps utilities to manage demand more efficiently.

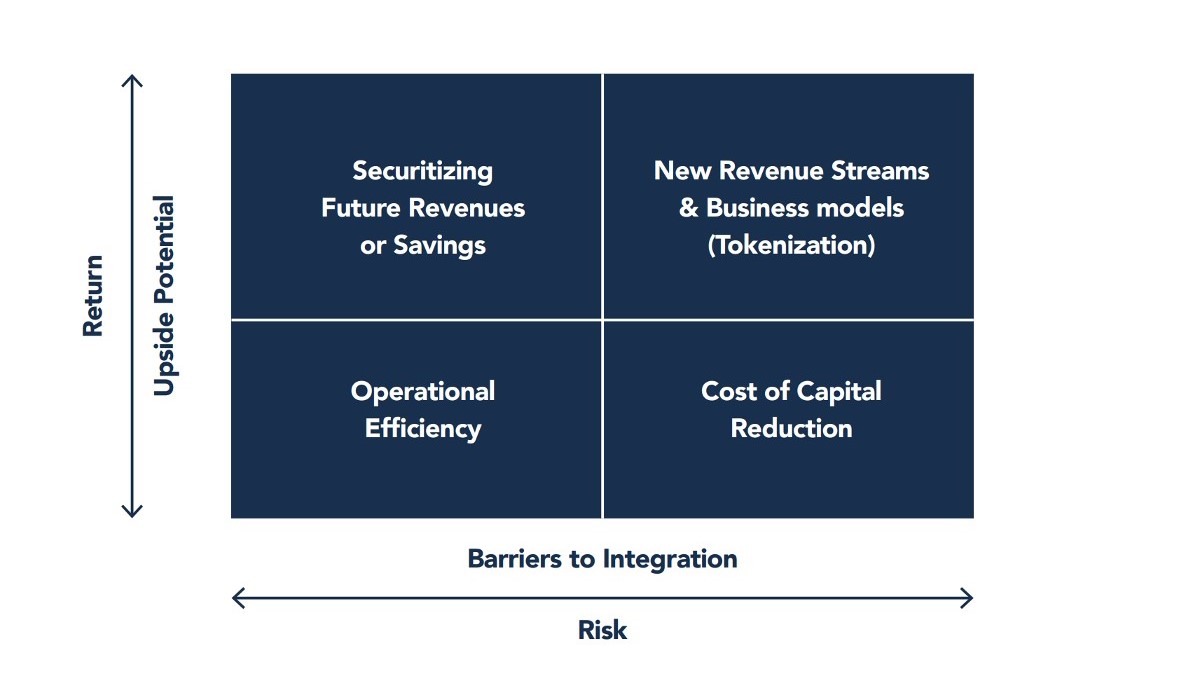

The above examples make it possible to display data-driven financing opportunities in a risk-return diagram. This maps barriers for integration against upside potential. For example, implementation may be hindered by technical causes, such as the cost of integrating revenues with assets, and non-technical causes such as stakeholder alignment. The upside potential reflects the total possible return.

Where fintech and climate-tech meet

Tokenization is the process of replacing confidential data with unique identification symbols that retain all the essential information about the data without compromising its security. Applied to infrastructure, tokenization could help to unlock huge amounts of investment capital. However, the technology is still immature, market demand very volatile, smart contracts not yet enforceable and financial institutions are not yet aligned with private contractors and government partners. Operational efficiencies could net benefits in the billions of dollars and some projects have already demonstrated how this can be done. Monitoring infrastructure assets with digital technologies is one way to assure investors, underwriters and ratings agencies and reduce the cost of capital.

The evolution of financial technology

Financial technology is changing how sustainable companies can capture value from new business models and benefit from operational efficiencies. Real-time data insights are impacting the valuation of assets and enabling a financial model structured to deliver returns using peer-to-peer trading for microgrids with companies.

The integration of IoT is generating an ocean of data that can be parsed and processed to uncover trends that create value as monetizable data streams. Whether in mobility, water, energy, waste or agricultural tech, the business models of innovative sustainable companies are increasingly adopting financial hedging models resulting from the growing use of IoT, monetization of data and repricing of risk.